Written by Anneri Fourie | Crises Control Executive

Security threats in financial institutions are evolving rapidly. While traditional risks like bank robberies still exist, digital threats, such as cyber fraud, phishing attacks, and unauthorised transactions, are growing at an alarming rate. According to a 2023 report by IBM, the average cost of a data breach in the financial sector reached £4.5 million per incident, making it one of the most targeted industries.

In addition to financial losses, security breaches can damage a bank’s reputation, erode customer trust, and result in severe regulatory penalties. Yet, many financial institutions still rely on outdated communication methods during crises, leading to delays in response and escalating risks.

Mass notification software has become a critical tool in strengthening security. It enables financial institutions to send real-time alerts, coordinate responses, and mitigate threats quickly, whether it’s an armed robbery, a suspicious transaction, or a cyberattack. When combined with incident management software, mass notification technology helps institutions automate responses, ensure compliance, and protect employees, customers, and assets.

This blog explores the growing security challenges in financial institutions, how mass notification software provides a solution, and why Crises Control is the ideal partner in safeguarding your organisation.

The Growing Security Threats in Financial Institutions

Financial institutions operate in a high-risk environment where security threats are increasingly complex. These risks fall into three main categories:

1. Physical Security Threats

- Bank Robberies: While less common than in previous decades, bank robberies still pose a threat, especially in high-cash-handling locations. A slow response can put employees and customers in danger.

- Unauthorised Access: Data centres, branch offices, and headquarters are prime targets for security breaches. Unauthorised entry by criminals or even disgruntled employees can lead to data theft or sabotage.

- Insider Threats: Not all threats come from outside. Employees with access to sensitive systems may misuse their privileges for financial gain or leak confidential data.

2. Cybersecurity Threats

- Phishing & Social Engineering: Fraudsters often target employees with deceptive emails or phone calls, tricking them into sharing login credentials or sensitive information.

- Unauthorised Transactions & Payment Fraud: Criminals attempt to exploit financial systems to move large sums of money through fraudulent transfers. A delayed response can result in irreversible losses.

- Data Breaches: Cybercriminals target banks to steal customer data, financial records, and intellectual property. Such breaches not only lead to financial losses but also attract regulatory fines and lawsuits.

3. Regulatory Compliance Risks

Financial institutions must comply with strict regulations such as the Financial Conduct Authority (FCA) guidelines in the UK and GDPR for data protection. Failure to respond to security incidents promptly can result in non-compliance, leading to hefty fines and legal consequences.

Given these challenges, financial institutions need a reliable, real-time communication system to respond swiftly and minimise damage.

How Mass Notification Software Enhances Security in Financial Institutions

Mass notification software provides financial institutions with the ability to communicate instantly across multiple channels, ensuring critical messages reach the right people at the right time. Here’s how it helps:

1. Real-Time Alerts for Physical Security Incidents

During a security breach, speed is everything. A mass notification system allows financial institutions to:

- Alert security teams and staff immediately in the event of a robbery or unauthorised access, enabling swift decision-making and response.

- Notify employees and customers with real-time instructions to stay safe.

- Trigger lockdown procedures for branches under threat.

For example, if an armed robbery occurs, a pre-configured mass notification can instantly alert security teams and staff, allowing the company to make prompt decisions and act quickly, which can help notify emergency services and reduce response time.

2. Rapid Response to Fraud and Cybersecurity Incidents

Cyber fraud is becoming more sophisticated, requiring immediate action to contain threats. Mass notification software enables financial institutions to:

- Alert fraud prevention teams the moment a suspicious transaction is detected.

- Notify customers in real time to verify potential fraud attempts.

- Warn employees of phishing attacks before they spread within the organisation.

By integrating mass notification software with fraud detection systems, banks can automate alerts and respond to cyber threats before damage occurs.

3. Multi-Channel Communication for Maximum Reach

During a crisis, relying on just one communication method (e.g., email) can be ineffective. Mass notification software ensures messages reach recipients by:

- Sending alerts via SMS, email, mobile app push notifications, and voice calls.

- Ensuring redundancy, so if one channel fails, others remain active.

- Reaching employees even if primary communication networks are down.

For example, if a bank’s IT team detects an attempted cyber breach, a mass notification can simultaneously alert executives, fraud teams, and security officers across different channels, ensuring a coordinated response.

4. Compliance Reporting and Incident Management

Financial institutions must document their response to security threats for regulatory compliance. Mass notification software:

- Automatically logs all alerts, responses, and actions taken.

- Generates compliance reports for regulatory bodies.

- Helps organisations review past incidents and refine response strategies.

With mass notification software, institutions can prove compliance while also improving their future incident response strategies.

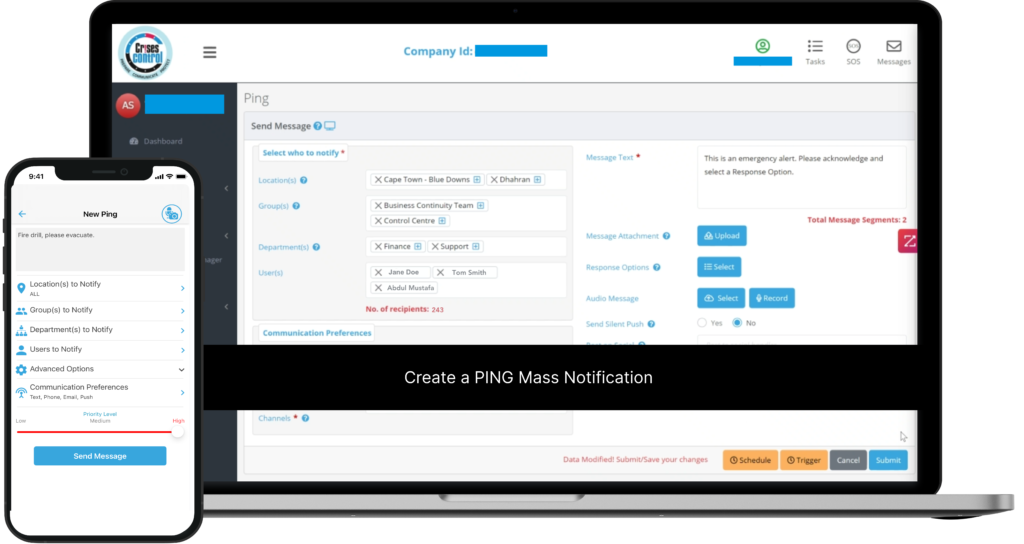

Interested in our Ping Mass Notification Software?

Efficiently alert everyone in seconds at scale with our Mass Notification Software – PING, get the message out fast and ensure rapid response and recovery.

How Crises Control Strengthens Security in Financial Institutions

Crises Control provides a comprehensive mass notification and incident management solution tailored for financial institutions. Here’s how it helps:

1. Ping Mass Notification

- Sends instant alerts across multiple channels, including SMS, email, phone calls, web alerts, and push notifications using the Crises Control App.

- Ensures messages reach employees, security teams, and executives immediately.

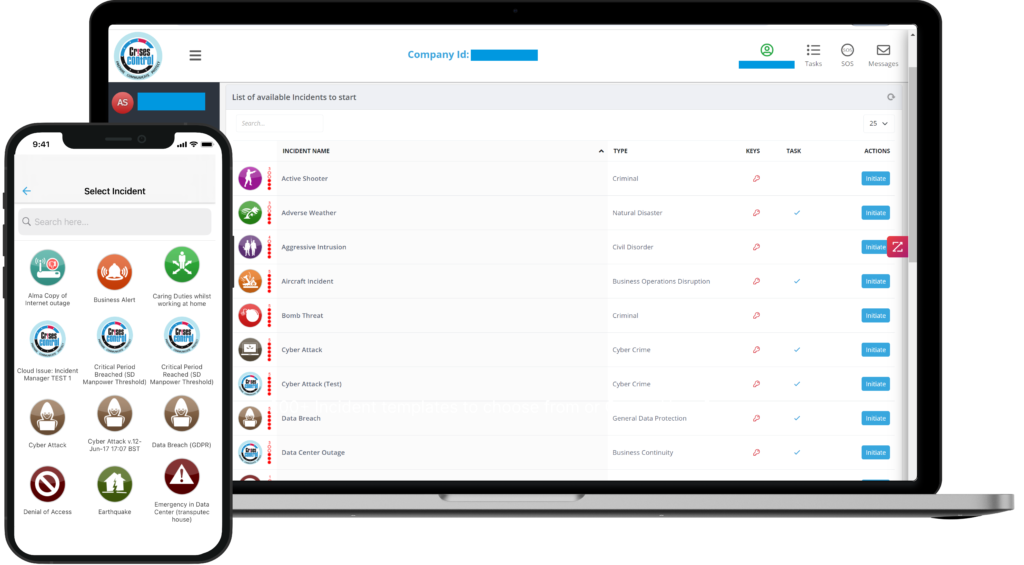

2. Incident Management Software

- Automates security response workflows, ensuring consistent and effective action.

- Provides real-time incident tracking for better coordination.

3. SOS Panic Button

- Allows employees to send discreet emergency alerts in case of physical threats.

- Sends location-based alerts for rapid response.

4. Task Manager for Crisis Response

- Assigns roles and responsibilities in real-time.

- Ensures security teams act without confusion or delays.

5. Reporting and Audit Compliance

- Maintains detailed incident records to meet regulatory requirements.

- Generates compliance reports with a full audit trail.

With Crises Control, financial institutions can respond faster, stay compliant, and protect their employees, customers, and assets.

Interested in our Incident Management Software?

Customise your Crisis Incident Management Software to meet your specific needs with our flexible tools & stay connected and informed during the crisis and incident management process

Conclusion: Protect Your Financial Institution Today

Security threats in financial institutions are unpredictable and costly, but with the right tools, they can be managed effectively. Mass notification software is a game-changer, enabling instant alerts, automated responses, and seamless incident management.

Crises Control provides a tailored mass notification and incident management solution designed to help financial institutions mitigate risks, strengthen security, and ensure compliance.

Don’t wait for a crisis—act now. Book a free personalised demo today and discover how Crises Control can protect your organisation.

Request a FREE Demo