Written by Anneri Fourie | Crises Control Executive

The cryptocurrency and blockchain industry is rapidly evolving, offering innovative financial solutions. However, with this growth comes increased regulatory scrutiny. Governments and financial authorities worldwide are tightening compliance requirements, demanding greater transparency and accountability from crypto firms.

Failing to meet these compliance standards can lead to severe financial penalties, reputational damage, and even the loss of operating licences. Keeping up with evolving regulations while securing digital assets against cyber threats is a significant challenge.

To navigate these complexities, crypto companies need robust Incident Management Software that enables swift responses to compliance breaches, security threats, and regulatory audits. This blog explores the compliance challenges in the crypto space, the role of Compliance Management Software, and how Crises Control provides an effective compliance solution for crypto and blockchain companies.

The Compliance Risks Facing Crypto and Blockchain Companies

Unlike traditional financial institutions, crypto businesses operate in a decentralised and fast-moving environment. However, this doesn’t mean they are free from government rules and checks. Below are some of the most pressing compliance risks facing crypto firms today:

1. Anti-Money Laundering (AML) and Know Your Customer (KYC) Violations

Regulatory bodies such as the Financial Action Task Force (FATF) and the European Union impose strict AML and KYC requirements on the cryptocurrency industry. Crypto companies must verify customer identities and monitor transactions to prevent financial crimes. However, the pressure to comply with these regulations varies depending on the jurisdiction. In some regions, crypto firms face more stringent enforcement, while in others, the regulatory landscape is still developing. This creates challenges for global companies operating in multiple regions, as they must navigate a patchwork of regulations and ensure they meet compliance standards in each jurisdiction.

Real-World Example: In February 2025, the operator of the OKX cryptocurrency exchange pleaded guilty to violating U.S. anti-money laundering laws. As part of the settlement, the company agreed to pay more than $505 million in fines and forfeitures. OKX was found to have operated an unlicensed money transmitting business and facilitated over $5 billion in suspicious transactions. This case underscores the severe consequences of non-compliance with AML regulations and highlights the increasing global regulatory scrutiny facing crypto firms.

2. FATF Travel Rule Compliance

The FATF Travel Rule requires crypto exchanges to share customer details when transferring digital assets above a certain threshold, ensuring greater transparency and reducing money laundering risks. While this is a crucial regulatory measure, its implementation has not been uniform across the globe. Some regions have fully embraced the rule, while others are still in the process of adapting or have not yet enacted similar requirements. This disparity creates challenges for crypto firms that operate internationally, as they must ensure compliance with varying regulations in different regions.

The lack of consistent global implementation means that crypto exchanges must invest in advanced compliance systems to meet the diverse requirements of each jurisdiction. These systems not only streamline reporting, but also help avoid penalties that may arise from failing to comply with regional regulations.

3. Security Breaches and Data Protection Issues

Crypto platforms are frequent targets of cyberattacks, primarily because of the high value of digital assets and the relatively young and evolving nature of the industry. These attacks range from phishing scams to large-scale exchange hacks. Centralised exchanges are particularly vulnerable due to their high-profile status and the vast sums of assets they manage. The lack of clear, globally standardised regulation in some areas also contributes to the problem, as cybercriminals exploit regulatory gaps to carry out attacks.

In addition to financial losses, crypto platforms face potential regulatory penalties under data protection laws such as the General Data Protection Regulation (GDPR). These laws require exchanges to maintain strict security protocols to safeguard personal and financial data. Failure to do so can result in severe fines and reputational damage, further emphasising the need for robust security and compliance measures.

4. Regulatory Audits and Investigations

Regulatory bodies frequently audit crypto firms to assess compliance with financial and data security regulations. If a company cannot provide clear records or demonstrate effective incident response procedures, it risks fines, legal action, or even suspension of operations.

Managing these risks manually is nearly impossible. Without structured incident management, firms struggle to track compliance breaches, respond to threats, and provide audit-ready documentation. This is where Incident Management Software becomes an essential tool for crypto companies.

The Role of Incident Management Software in Compliance Breaches

When a compliance breach occurs, the speed and efficiency of a company’s response can determine whether it recovers quickly or faces serious regulatory consequences. Incident Management Software helps crypto businesses take control of compliance incidents by:

1. Detecting and Reporting Compliance Violations in Real-Time

- Automatic Detection: The software integrates with security and monitoring systems that can flag unusual activities, such as unverified high-value transactions, triggering immediate attention and enabling a rapid response.

- Instant Alerts: Compliance officers and security teams receive real-time notifications, allowing for prompt action.

- Secure Logging: All incidents are recorded in a protected, cloud-based system, ensuring data integrity and accessibility for review.

2. Providing a Structured Response to Regulatory Breaches

- Predefined Workflows: The software ensures compliance teams follow established procedures, reducing the likelihood of oversight.

- Responsibility Assignment: Tasks are allocated to specific stakeholders, preventing delays and confusion during incident response.

- Clear Escalation Paths: High-risk incidents are escalated appropriately, ensuring that critical issues receive the necessary attention.

3. Maintaining Audit-Ready Documentation and Reports

- Automated Reporting: Detailed compliance reports are generated without manual intervention, saving time and reducing errors.

- Tamper-Proof Records: Incident details are stored securely, creating a transparent and unalterable audit trail.

- Simplified Audits: Organised and accessible data facilitates smoother interactions with regulators during audits.

4. Enabling Secure and Efficient Communication

- Mass Notifications: Key personnel are informed simultaneously during a crisis, ensuring everyone is on the same page.

- Encrypted Messaging: Secure communication channels prevent data leaks and maintain confidentiality.

- Consistent Messaging: The software ensures that all communications align with regulatory requirements and internal policies.

A well-implemented Incident Management Software not only helps companies stay compliant, but also protects them from reputational, physical and financial damage.

How Crises Control Strengthens Incident Management for Crypto Compliance

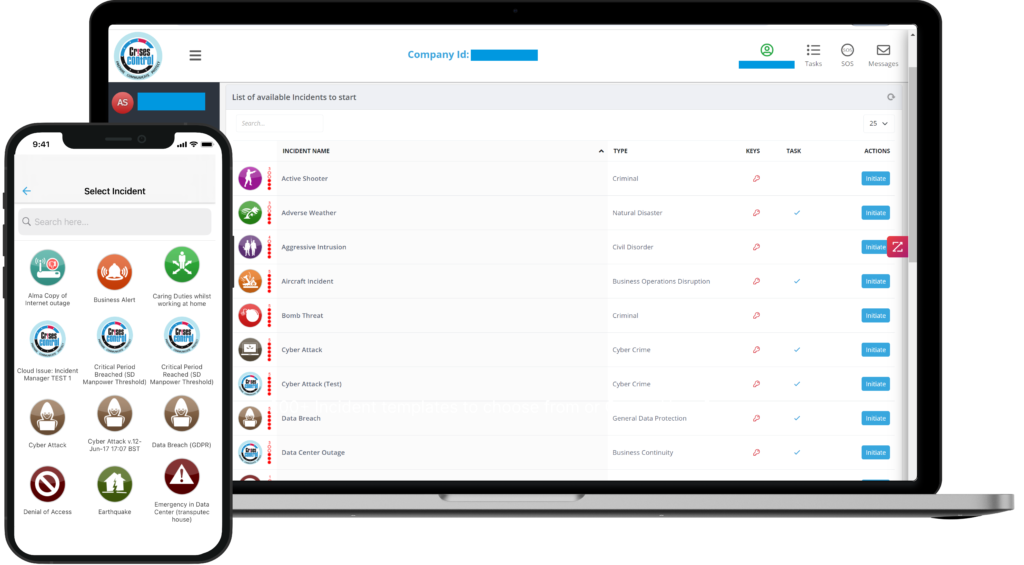

Crises Control is an advanced Incident Management Software designed to help crypto and blockchain firms respond to compliance incidents effectively, ensuring operational continuity and regulatory adherence.

1. Real-Time Alerts and Mass Notifications

- Incident Management Support: Crises Control helps manage compliance-related incidents by streamlining the response process, ensuring that risks are addressed quickly once detected by compliance monitoring systems.

- Centralised Tracking: The platform offers a unified view of all incidents, facilitating coordinated responses.

- Instant Updates: Key decision-makers receive timely information, enabling informed choices during critical situations.

2. Automated Workflows for Compliance Violations

- Customisable Processes: Workflows can be tailored to meet specific regulatory requirements and organisational needs.

- Efficiency Boost: Automation reduces manual tasks, accelerating response times and minimising the potential for human error.

- Protocol Adherence: The software ensures that all actions comply with relevant regulations, safeguarding the company from legal repercussions.

3. Secure and Tamper-Proof Documentation for Audit Readiness

- Protected Storage: Compliance records are stored in a secure, cloud-based environment, preventing unauthorised access.

- Automatic Logging: Incident details are recorded systematically, providing a clear and comprehensive audit trail.

- Easy Retrieval: Organised documentation simplifies the process of retrieving information during regulatory reviews.

4. Integrated Compliance Reporting and Analytics

- Comprehensive Reports: Detailed documents are generated to meet both regulatory and internal audit requirements.

- Incident Tracking: Crises Control helps track and document compliance-related incidents, providing visibility into recurring issues that can inform future improvements to security and response strategies.

- Data-Driven Decisions: Real-time analytics support informed decision-making, enhancing the organisation’s overall compliance strategy.

By integrating Crises Control, crypto firms can strengthen their compliance management, improve response times, and stay ahead of regulatory changes.

Interested in our Incident Management Software?

Customise your Crisis Incident Management Software to meet your specific needs with our flexible tools & stay connected and informed during the crisis and incident management process

Best Practices for Crypto Companies Using Incident Management Software

To fully benefit from Incident Management Software, crypto businesses should implement the following best practices:

1. Conduct Regular Compliance Drills

Simulate real-world scenarios such as regulatory audits, security breaches, and AML/KYC violations to test your company’s response capabilities. Regular drills help identify weaknesses in procedures and ensure that staff are prepared for actual incidents.

2. Define Clear Escalation Paths for Compliance Breaches

Establish predefined reporting structures to ensure that compliance teams, legal advisors, and senior management can make swift, informed decisions during incidents.

3. Keep Detailed Compliance Records

Regulatory audits can occur at any time, and being prepared with comprehensive records is essential. Ensure that all incidents, responses, and corrective actions are documented within your incident management system. This not only streamlines audits, but also demonstrates proactive compliance efforts to regulators.

4. Train Employees on Incident Response Protocols

A robust compliance strategy is only as strong as the people implementing it. Regularly train employees on how to recognise compliance breaches, report incidents, and follow escalation procedures. Well-informed teams reduce the risk of human error and improve response efficiency.

5. Continuously Update Compliance Procedures

Regulatory frameworks in the crypto industry evolve frequently. Businesses must stay ahead of these changes by regularly reviewing and updating their incident response protocols. Leveraging an adaptable incident management platform like Crises Control ensures that compliance measures remain effective and up to date.

Future-Proofing Compliance with Incident Management Software

The crypto and blockchain industry is under increasing regulatory scrutiny, with new laws and compliance requirements emerging globally. Staying compliant while ensuring operational continuity requires a proactive approach to risk management.

Incident Management Software is no longer optional; it is a necessity for crypto businesses aiming to avoid regulatory penalties, reputational damage, and financial losses. By automating compliance processes, enabling rapid responses to incidents, and maintaining audit-ready documentation, platforms like Crises Control provide a powerful solution for crypto firms navigating the complex world of regulatory compliance.

Stay Ahead of Compliance Risks with Crises Control

At Crises Control, we can help crypto and blockchain companies manage compliance incidents efficiently and safeguard their operations from regulatory threats. Our incident management platform provides real-time alerts, structured workflows, secure documentation, and automated compliance reporting to keep your business protected.

Don’t wait for a compliance breach to disrupt your operations—take control today!

Get a free personalised demo to see how Crises Control can help your organisation meet compliance requirements and strengthen its incident response strategy.

Request a FREE Demo