Written by Anneri Fourie | Marketing Executive

In the high-stakes world of insurance, where every decision can impact clients’ lives and businesses, effective crisis communication is crucial. Whether it’s a natural disaster, cyber-attack, or other unforeseen events, insurance companies must be equipped to respond swiftly and efficiently to minimise disruptions and maintain client trust.

A well-implemented emergency mass notification system can be the cornerstone of such a response, ensuring that all stakeholders—internal teams, clients, and partners—are informed and coordinated when it matters most.

In this blog, we will explore how a well-implemented emergency mass notification system can be the cornerstone of an effective crisis response, ensuring that all stakeholders—internal teams, clients, and partners—are informed and coordinated when it matters most. Additionally, we’ll highlight how Crises Control can be your trusted partner in crisis management.

The Vital Role of Crisis Communication in the Insurance Industry

Crisis communication isn’t just about sending out messages; it’s about delivering the right message to the right people at the right time. For insurance companies, this involves coordinating responses across multiple departments, communicating with clients, and ensuring compliance with industry regulations. A misstep in communication during a crisis can lead to operational disruptions, financial losses, and, most critically, a loss of trust from clients who depend on the insurer’s reliability.

Insurance companies often face unique challenges during crises:

- Complex Coordination: Multiple departments may handle different aspects of a crisis. Coordinating responses efficiently is critical to avoid costly errors.

- Client Expectations: Clients expect timely updates and clear instructions during emergencies. Any delay in communication can erode trust and damage the company’s reputation.

- Regulatory Compliance: Insurance companies are subject to stringent regulations, especially during crises. Ensuring that all communication adheres to these regulations while being timely and accurate adds another layer of complexity.

Given these challenges, it’s clear that insurance companies need a robust solution to streamline their crisis communication. This is where an emergency mass notification system becomes indispensable.

How an Emergency Mass Notification System Streamlines Crisis Communication

An emergency mass notification system (EMNS) is more than just a tool for sending alerts; it’s a comprehensive solution designed to ensure that all relevant stakeholders are informed and coordinated in real time. Here’s how an EMNS can benefit insurance companies:

1. Automated Alerts for Rapid Response

During a crisis, every second counts. An EMNS automates the process of sending alerts to various stakeholders, significantly reducing the time it takes to communicate critical information. With pre-set templates and automation, insurance companies can ensure that the right message reaches the right people immediately.

Automation also reduces the risk of human error during high-pressure situations. By automating the alert process, insurance companies can maintain consistency in their messaging, ensuring that all stakeholders receive accurate and timely information.

2. Multi-Channel Communication for Maximum Reach

Relying on a single communication channel during a crisis is risky. People may not always be accessible via email, or they might miss a phone call. An EMNS offers multi-channel communication, allowing insurance companies to reach stakeholders through various channels simultaneously—SMS, email, phone calls, mobile apps, and more. This ensures the message gets through, regardless of the stakeholder’s preferred method of communication.

For insurance companies, this means that clients, employees, and partners are more likely to receive critical updates in a timely manner, no matter where they are or what communication method they rely on.

3. Targeted Messaging for Specific Stakeholders

During a crisis, different departments or groups may need different instructions. An EMNS allows insurance companies to send targeted messages to specific groups or individuals, ensuring each stakeholder receives information relevant to their role in the crisis response.

For instance, the claims department might need to know how to handle an influx of claims, while the IT department may need to focus on safeguarding digital assets. Targeted messaging allows for a more efficient and effective response by ensuring that everyone is informed of their specific responsibilities.

4. Real-Time Updates for Continuous Communication

Crises are dynamic, with situations evolving rapidly. An EMNS provides the capability for real-time updates, allowing insurance companies to keep all stakeholders informed as the situation develops. This continuous communication is critical for maintaining coordination and ensuring that everyone remains aligned with the latest information.

Real-time updates also help manage client expectations. By keeping clients informed throughout the crisis, insurance companies can reduce anxiety and maintain trust, even when the situation is complex and evolving.

Enhancing Internal and External Communication

An EMNS not only helps coordinate internal efforts, but also ensures clear communication with clients and partners during a crisis.

1. Improving Internal Coordination

Within an insurance company, crises often require coordinated efforts across various departments. An EMNS provides a platform for efficient and reliable internal communication.

- Employee Coordination: The system can be used to assign tasks, monitor progress, and ensure that all employees know their roles and responsibilities during a crisis. This reduces confusion and ensures that the crisis response is well-organised.

- Incident Reporting and Feedback: The system also enables quick incident reporting and feedback loops, allowing for better decision-making and faster resolution of the crisis.

2. Enhancing Client Communication

Clients depend on their insurance providers for timely updates during a crisis. An EMNS enables insurance companies to send out regular updates, keeping clients informed of the situation and any actions they need to take. This proactive communication can significantly influence how clients perceive the company’s handling of the crisis.

For example, if a natural disaster is imminent, clients can be informed about how to file claims, what to expect in terms of response times, and any precautions they should take. This not only helps maintain trust, but also ensures that clients are better prepared to handle the crisis.

3. Coordinating with Partners

Insurance companies often work with various partners, such as claims adjusters, legal teams, and emergency response organisations, during a crisis. An EMNS ensures that all partners are kept in the loop, with clear instructions on their roles and responsibilities. This coordination is crucial for a seamless response, ensuring that all aspects of the crisis are managed effectively.

By keeping partners informed and aligned, insurance companies can avoid delays, reduce miscommunication, and ensure that the entire response process runs smoothly.

How Crises Control Can Help Insurance Companies Streamline Crisis Communication

Crises Control is a leading provider of emergency mass notification systems, offering a comprehensive platform designed to meet the unique needs of the insurance industry. Here’s how Crises Control can help:

1. Automated and Targeted Alerts

Crises Control’s platform enables insurance companies to automate the sending of alerts, ensuring that critical information reaches the right stakeholders without delay. The system also allows for targeted messaging, so you can communicate specific instructions to different departments, clients, or partners, ensuring a coordinated response.

2. Multi-Channel Communication

With Crises Control, you can reach your stakeholders through multiple communication channels, including SMS, email, phone calls, and mobile apps. This multi-channel approach ensures that your message is received, no matter the circumstances.

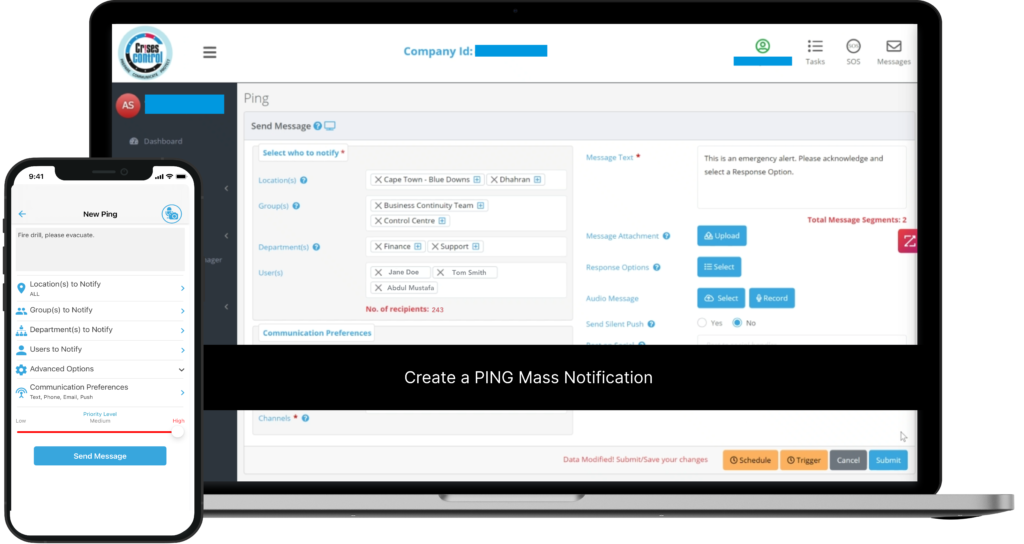

Interested in our Ping Mass Notification Software?

Efficiently alert everyone in seconds at scale with our Mass Notification System – PING, get the message out fast and ensure rapid response and recovery.

3. Real-Time Incident Management

Crises Control supports real-time incident management, allowing you to provide continuous updates to all stakeholders throughout the crisis. This feature is crucial for maintaining alignment and ensuring that everyone has the most up-to-date information.

4. Seamless Integration with Existing Systems

Crises Control seamlessly integrates with your existing systems, enhancing your overall crisis management capabilities. Whether you need to communicate with internal teams, clients, or partners, Crises Control makes it easy to streamline your communication efforts.

5. Comprehensive Reporting and Analytics

Crises Control’s platform includes robust reporting and analytics features, allowing you to review the effectiveness of your communication during a crisis and make improvements for the future. This data-driven approach helps insurance companies refine their crisis communication strategies over time.

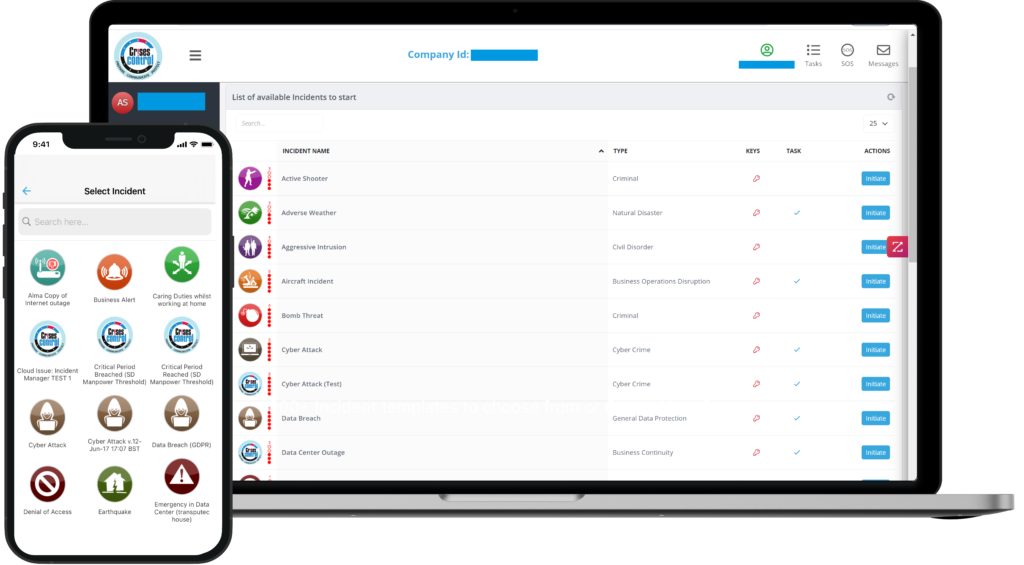

Interested in our Incident Management Software?

Customise your Crisis Incident Management Software to meet your specific needs with our flexible tools & stay connected and informed during the crisis and incident management process

Conclusion: Take Control of Crisis Communication with Crises Control

In the insurance industry, effective crisis communication is not just a necessity—it’s a competitive advantage. An emergency mass notification system is the key to ensuring that all stakeholders are informed, coordinated, and ready to respond during a crisis. Crises Control offers a comprehensive solution that empowers insurance companies to streamline their crisis communication, protect their clients, and maintain business continuity.

Don’t wait for the next crisis to expose gaps in your communication strategy. Take proactive steps to enhance your crisis communication capabilities with Crises Control. Contact us today for a free personalised demo and discover how our emergency mass notification system can transform your crisis management approach.

Request a FREE Demo