Written by Anneri Fourie | Marketing Executive

The banking sector operates in a high-stakes environment where even minor disruptions can have severe financial and reputational consequences. A cyberattack, IT failure, security breach, or regulatory change can trigger a crisis, impacting business continuity and customer trust.

Despite these risks, many banks still rely on manual crisis response plans, scattered documentation, and outdated communication methods, leading to slow decision-making, poor coordination, and increased vulnerability.

This is where Business Continuity Software and Mass Notification Systems become essential. By automating crisis response, streamlining communication, and ensuring uninterrupted operations, banks can navigate disruptions effectively and minimise downtime.

Why Banks Need Business Continuity Software

The financial sector is one of the most highly regulated industries, with strict requirements for risk management, data protection, and operational resilience. A single disruption, whether caused by cyber threats, IT failures, or physical security breaches, can lead to:

- Regulatory penalties for non-compliance.

- Financial losses from system downtime and disrupted transactions.

- Reputational damage, reducing customer confidence.

- Security risks, including data breaches and fraud.

Yet, many banks still use static business continuity plans stored in PDFs or outdated manuals. These documents are rarely updated, hard to access in an emergency, and require manual execution, leading to delays and confusion.

How Business Continuity Software Helps

A modern Business Continuity Software solution like Crises Control enables banks to:

- Automate Response Plans: Predefined workflows ensure employees follow the right steps during a crisis.

- Ensure 24/7 Accessibility: Plans are securely stored in the cloud and accessible from any device.

- Provide Real-Time Updates: Teams receive instant alerts, updates, and task assignments.

- Maintain Regulatory Compliance: Built-in reporting tools generate audit trails, making compliance easier.

With Crises Control, banks can digitise, automate, and centralise their crisis management strategy, ensuring a seamless and compliant response to disruptions.

The Role of a Mass Notification System in Banking Crisis Management

During a crisis, effective communication is the first and most crucial step in preventing escalation. Banks need to notify the right stakeholders instantly, whether it’s employees, regulators, or customers.

A Mass Notification System ensures that critical messages are delivered immediately via:

- SMS: Instant updates to employees and customers.

- Email: Detailed reports and compliance documentation.

- Push Notifications: Alerts directly to mobile devices.

- Voice Calls: Automated calls for urgent escalation.

Why Banks Need Instant Alerts

- Cyberattacks: Banks experience constant threats from fraud, phishing, and ransomware. Instant alerts can warn employees and customers, minimising damage.

- System Failures: Core banking outages and ATM network failures can impact millions of customers. Rapid internal communication ensures quick resolution.

- Physical Security Threats: Armed robberies or violent incidents require real-time alerts to protect staff and customers.

- Regulatory Alerts: Changes in financial regulations require immediate communication to ensure compliance across the organisation.

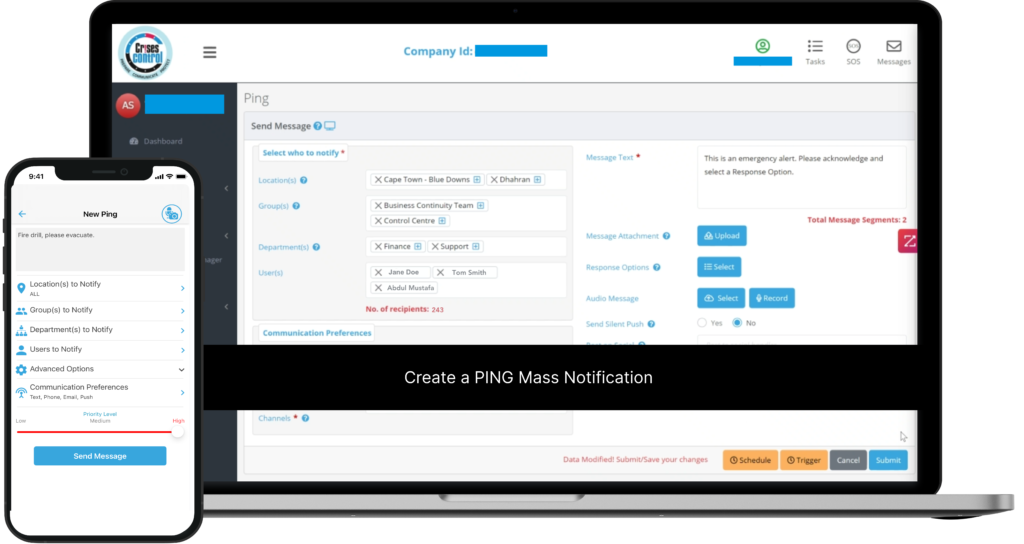

Interested in our Ping Mass Notification Software?

Efficiently alert everyone in seconds at scale with our Mass Notification Software – PING, get the message out fast and ensure rapid response and recovery.

How Crises Control Strengthens Banking Resilience

Crises Control provides a comprehensive crisis management solution tailored for the banking industry:

- Ping Mass Notification System: Instantly notify employees, customers, and regulators using SMS, email, push notifications, and voice calls.

- Incident Management System: Automate response workflows, assign recovery tasks, and track real-time progress.

- Digital Business Continuity Plans: Access and update crisis response plans from anywhere, at any time with secure cloud storage.

- Compliance and Reporting Tools: Automatically generate audit trails, ensuring adherence to financial regulations and risk management policies.

- Integration with Banking Infrastructure: Seamlessly connect with core banking systems, fraud detection platforms, and IT monitoring tools to trigger automatic alerts.

- Mobile-First Accessibility: Activate response plans and send alerts directly from mobile devices, ensuring executives and IT teams can respond on the go.

With Crises Control, banks gain automated, real-time crisis management capabilities, reducing financial risks and ensuring uninterrupted operations.

Case Study: Enhancing Crisis Communication for a Leading Financial Services Provider

A leading financial services provider with 400 employees in London and a mobile workforce across Europe faced challenges in effectively communicating critical incidents, such as severe weather and terrorist attacks, to their staff.

Challenge

The firm needed a solution to alert employees in real-time via email, SMS, voice calls, and push notifications, both at the London HQ and while traveling across EMEA. The existing manual communication methods were slow and inefficient, risking employee safety and delayed response times.

Solution

Crises Control’s platform was deployed to streamline incident communication, enabling the firm to notify staff quickly and track their safety during crises. The Ping Message function was particularly valuable during evacuation drills, ensuring employees spread out as per new security guidelines.

The platform was used during real-world incidents such as the London Bridge terrorist attack in 2017 and the Munich shooting rampage in 2016, where staff were warned to avoid affected areas.

Customer Experience

The Director of HR shared that Crises Control allowed for:

- Quick communication: Instant alerts with acknowledgment responses, ensuring employee safety.

- Ease of use: The platform’s intuitive design made it simple for staff to use, even during crises.

- Effective onboarding: Staff received comprehensive training through real-world scenarios, ensuring they were well-prepared.

Outcome

Crises Control improved crisis communication, enhanced employee safety, and ensured compliance with security protocols, providing the financial services provider with a more efficient and reliable crisis management solution.

Conclusion: Future-Proof Your Bank’s Crisis Response

The financial sector cannot afford delays in crisis response. Cyber threats, IT failures, and regulatory pressures demand a proactive, technology-driven approach to crisis management.

Without the right tools, banks risk financial losses, reputational damage, and compliance failures.

Crises Control’s Business Continuity Software and Mass Notification System provide the tools banks need to stay prepared, respond rapidly, and recover efficiently, ensuring uninterrupted operations and long-term resilience.

Don’t wait for a crisis to test your bank’s resilience. Contact us today for a free personalised demo and see how Crises Control can safeguard your institution.

Request a FREE Demo